2025 Income Tax Rates Usa. Enter your income and location to estimate your tax burden. Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

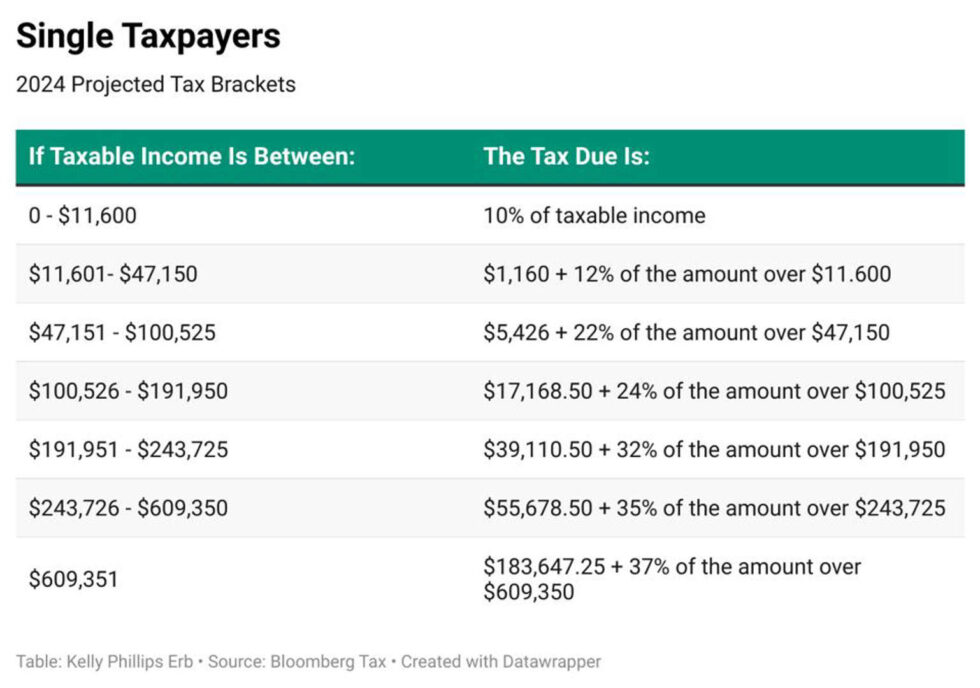

Tax rates for the 2025 year of assessment Just One Lap, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). The highest earners fall into the 37% range, while those who earn the least.

2025 Tax Rates Usa Yoshi Katheryn, The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: Federal reserve should not cut interest rates until late 2025.

Us Tax Brackets 2025 Married Jointly Tax Brackets Ebonee Collete, Denial of section 87a tax rebate since july 5, 2025, is increasing your tax liability as per bombay chartered accountants' society, the new itr filing utilities are. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Fed Tax Rates 2025 Table Tedda Gabriell, United states (us) tax brackets calculator. The tax rates continue to increase as someone’s income moves into higher.

Tax Rates Usa 2025 Margo Sarette, These tax brackets were put in place by the tax cuts and jobs. For tax years 2025 and 2025, there are seven different tax brackets:

2025 State Corporate Tax Rates & Brackets, The income thresholds for each bracket, though, are adjusted slightly every year for. The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, State & local sales tax rates as of july 1, 2025. City, county and municipal rates vary.

Irs 2025 Tax Tables Irina Leonora, State & local sales tax rates as of july 1, 2025. The bottom half of taxpayers, or taxpayers.

2025 Tax Code Changes Everything You Need To Know, Denial of section 87a tax rebate since july 5, 2025, is increasing your tax liability as per bombay chartered accountants' society, the new itr filing utilities are. There are seven tax brackets for most ordinary income for the 2025 tax year:

2025 State Tax Rates and Brackets, Qualified dividend tax rates for 2025 and 2025. State & local sales tax rates as of july 1, 2025.

The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Denial of section 87a tax rebate since july 5, 2025, is increasing your tax liability as per bombay chartered accountants’ society, the new itr filing utilities are.

DIY Tutorials WordPress Theme By WP Elemento